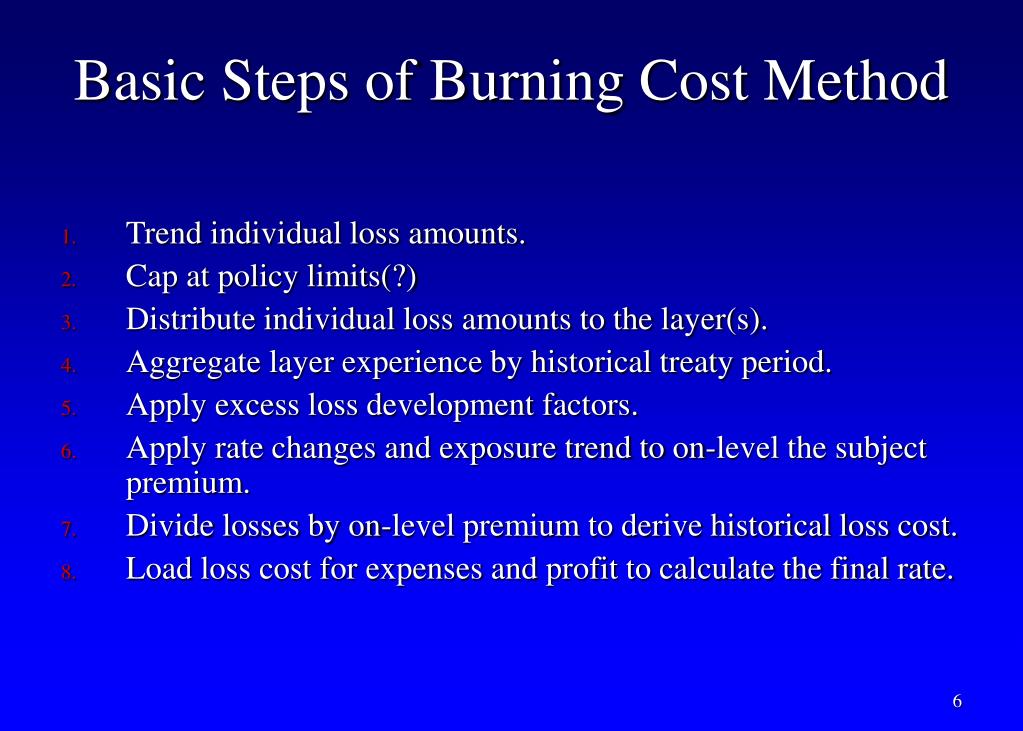

Burning Cost In Reinsurance Example . The burning cost approach is quite simple to understand: the burning cost approach is probably the most widely used approach in reinsurance pricing. calculates premium, identifying the related acquisition and administration costs. overview of reinsurance | treaty proportional. The exposure method and 3. the three commonest methods for determining the price of an excess of loss treaty are the 1. Insurer cedes a percentage of each risk to the reinsurer. the simplest method used is the “burning cost” method. For each experience year, after reevaluating the premiums and the losses due to inflation, we calculate the amount of losses recovered by the treaty, and determine the ratio of “annual aggregate recoveries for the years to the. Cedes part of the original premium, including the. The popularity of this approach stems from. The burning cost method, 2.

from www.slideserve.com

the simplest method used is the “burning cost” method. The burning cost method, 2. Cedes part of the original premium, including the. overview of reinsurance | treaty proportional. calculates premium, identifying the related acquisition and administration costs. The burning cost approach is quite simple to understand: The popularity of this approach stems from. Insurer cedes a percentage of each risk to the reinsurer. The exposure method and 3. the burning cost approach is probably the most widely used approach in reinsurance pricing.

PPT Experience Rating for Excess Of Loss Contracts 2004 CAS

Burning Cost In Reinsurance Example the burning cost approach is probably the most widely used approach in reinsurance pricing. The burning cost method, 2. The popularity of this approach stems from. the burning cost approach is probably the most widely used approach in reinsurance pricing. calculates premium, identifying the related acquisition and administration costs. Cedes part of the original premium, including the. For each experience year, after reevaluating the premiums and the losses due to inflation, we calculate the amount of losses recovered by the treaty, and determine the ratio of “annual aggregate recoveries for the years to the. Insurer cedes a percentage of each risk to the reinsurer. The burning cost approach is quite simple to understand: the simplest method used is the “burning cost” method. overview of reinsurance | treaty proportional. The exposure method and 3. the three commonest methods for determining the price of an excess of loss treaty are the 1.

From www.slideserve.com

PPT Introduction to Experience Rating PowerPoint Presentation, free Burning Cost In Reinsurance Example Insurer cedes a percentage of each risk to the reinsurer. The popularity of this approach stems from. the simplest method used is the “burning cost” method. overview of reinsurance | treaty proportional. For each experience year, after reevaluating the premiums and the losses due to inflation, we calculate the amount of losses recovered by the treaty, and determine. Burning Cost In Reinsurance Example.

From www.slideserve.com

PPT Introduction to Experience Rating PowerPoint Presentation, free Burning Cost In Reinsurance Example calculates premium, identifying the related acquisition and administration costs. The exposure method and 3. The burning cost approach is quite simple to understand: The burning cost method, 2. Cedes part of the original premium, including the. the three commonest methods for determining the price of an excess of loss treaty are the 1. The popularity of this approach. Burning Cost In Reinsurance Example.

From www.slideserve.com

PPT INTRODUCTION TO REINSURANCE PowerPoint Presentation, free Burning Cost In Reinsurance Example the simplest method used is the “burning cost” method. overview of reinsurance | treaty proportional. calculates premium, identifying the related acquisition and administration costs. The exposure method and 3. The burning cost method, 2. For each experience year, after reevaluating the premiums and the losses due to inflation, we calculate the amount of losses recovered by the. Burning Cost In Reinsurance Example.

From www.slideserve.com

PPT WHY DO WE NEED REINSURANCE PowerPoint Presentation, free download Burning Cost In Reinsurance Example the simplest method used is the “burning cost” method. the three commonest methods for determining the price of an excess of loss treaty are the 1. calculates premium, identifying the related acquisition and administration costs. For each experience year, after reevaluating the premiums and the losses due to inflation, we calculate the amount of losses recovered by. Burning Cost In Reinsurance Example.

From www.slideserve.com

PPT Reinsurance PowerPoint Presentation, free download ID4654583 Burning Cost In Reinsurance Example the three commonest methods for determining the price of an excess of loss treaty are the 1. Insurer cedes a percentage of each risk to the reinsurer. calculates premium, identifying the related acquisition and administration costs. The burning cost approach is quite simple to understand: The popularity of this approach stems from. the burning cost approach is. Burning Cost In Reinsurance Example.

From www.slideserve.com

PPT Assignment Ten PowerPoint Presentation, free download ID765787 Burning Cost In Reinsurance Example the three commonest methods for determining the price of an excess of loss treaty are the 1. The popularity of this approach stems from. the burning cost approach is probably the most widely used approach in reinsurance pricing. the simplest method used is the “burning cost” method. The burning cost approach is quite simple to understand: Insurer. Burning Cost In Reinsurance Example.

From www.slideserve.com

PPT Chapter 6 Insurance Company Operations PowerPoint Presentation Burning Cost In Reinsurance Example the burning cost approach is probably the most widely used approach in reinsurance pricing. the three commonest methods for determining the price of an excess of loss treaty are the 1. The burning cost method, 2. Cedes part of the original premium, including the. The burning cost approach is quite simple to understand: The exposure method and 3.. Burning Cost In Reinsurance Example.

From www.youtube.com

BURNING COST NP REINSURANCE PREMIUM YouTube Burning Cost In Reinsurance Example the three commonest methods for determining the price of an excess of loss treaty are the 1. calculates premium, identifying the related acquisition and administration costs. The popularity of this approach stems from. The burning cost method, 2. The exposure method and 3. For each experience year, after reevaluating the premiums and the losses due to inflation, we. Burning Cost In Reinsurance Example.

From www.slideserve.com

PPT Introduction to Experience Rating PowerPoint Presentation, free Burning Cost In Reinsurance Example For each experience year, after reevaluating the premiums and the losses due to inflation, we calculate the amount of losses recovered by the treaty, and determine the ratio of “annual aggregate recoveries for the years to the. The burning cost approach is quite simple to understand: the burning cost approach is probably the most widely used approach in reinsurance. Burning Cost In Reinsurance Example.

From www.slideserve.com

PPT Reinsurance PowerPoint Presentation, free download ID2970995 Burning Cost In Reinsurance Example Insurer cedes a percentage of each risk to the reinsurer. overview of reinsurance | treaty proportional. The exposure method and 3. Cedes part of the original premium, including the. For each experience year, after reevaluating the premiums and the losses due to inflation, we calculate the amount of losses recovered by the treaty, and determine the ratio of “annual. Burning Cost In Reinsurance Example.

From www.slideserve.com

PPT Assignment Ten PowerPoint Presentation ID765787 Burning Cost In Reinsurance Example The exposure method and 3. For each experience year, after reevaluating the premiums and the losses due to inflation, we calculate the amount of losses recovered by the treaty, and determine the ratio of “annual aggregate recoveries for the years to the. calculates premium, identifying the related acquisition and administration costs. the simplest method used is the “burning. Burning Cost In Reinsurance Example.

From contracts.justia.com

Property Aggregate Excess of Loss Reinsurance Contract effective Burning Cost In Reinsurance Example the simplest method used is the “burning cost” method. The popularity of this approach stems from. the three commonest methods for determining the price of an excess of loss treaty are the 1. The exposure method and 3. the burning cost approach is probably the most widely used approach in reinsurance pricing. Insurer cedes a percentage of. Burning Cost In Reinsurance Example.

From www.researchgate.net

Calculation of the average burn rate from the total affordable R&D cost Burning Cost In Reinsurance Example The popularity of this approach stems from. The burning cost method, 2. The burning cost approach is quite simple to understand: the simplest method used is the “burning cost” method. For each experience year, after reevaluating the premiums and the losses due to inflation, we calculate the amount of losses recovered by the treaty, and determine the ratio of. Burning Cost In Reinsurance Example.

From www.slideserve.com

PPT Introduction to Experience Rating PowerPoint Presentation, free Burning Cost In Reinsurance Example the burning cost approach is probably the most widely used approach in reinsurance pricing. the three commonest methods for determining the price of an excess of loss treaty are the 1. The burning cost method, 2. The burning cost approach is quite simple to understand: the simplest method used is the “burning cost” method. The popularity of. Burning Cost In Reinsurance Example.

From loginportal.udlvirtual.edu.pe

Different Types Of Reinsurance Products Login pages Info Burning Cost In Reinsurance Example The burning cost approach is quite simple to understand: overview of reinsurance | treaty proportional. The popularity of this approach stems from. the simplest method used is the “burning cost” method. Cedes part of the original premium, including the. For each experience year, after reevaluating the premiums and the losses due to inflation, we calculate the amount of. Burning Cost In Reinsurance Example.

From www.slideserve.com

PPT Reinsurance PowerPoint Presentation, free download ID1412710 Burning Cost In Reinsurance Example The burning cost approach is quite simple to understand: the simplest method used is the “burning cost” method. The exposure method and 3. Cedes part of the original premium, including the. Insurer cedes a percentage of each risk to the reinsurer. The burning cost method, 2. The popularity of this approach stems from. calculates premium, identifying the related. Burning Cost In Reinsurance Example.

From www.investopedia.com

BurningCost Ratio What it is and How It Works Burning Cost In Reinsurance Example the three commonest methods for determining the price of an excess of loss treaty are the 1. The popularity of this approach stems from. The exposure method and 3. Insurer cedes a percentage of each risk to the reinsurer. the simplest method used is the “burning cost” method. calculates premium, identifying the related acquisition and administration costs.. Burning Cost In Reinsurance Example.

From www.slideserve.com

PPT INTRODUCTION TO REINSURANCE PowerPoint Presentation, free Burning Cost In Reinsurance Example Cedes part of the original premium, including the. The burning cost approach is quite simple to understand: the three commonest methods for determining the price of an excess of loss treaty are the 1. The popularity of this approach stems from. overview of reinsurance | treaty proportional. calculates premium, identifying the related acquisition and administration costs. The. Burning Cost In Reinsurance Example.